What is one of the most important parts of running a grocery store? Answer: Keeping a grasp on your finances while also keeping your customer information secure.

Safeguarding your financial information is paramount, especially during routine activities like grocery shopping. A prevalent threat in such environments is the use of PIN pad skimmers—clandestine devices designed to steal your card data and personal identification numbers (PINs) during transactions. This article delves into the nature of these skimmers, how to identify them in grocery stores, and the technological measures that can help you avoid falling victim to such scams.

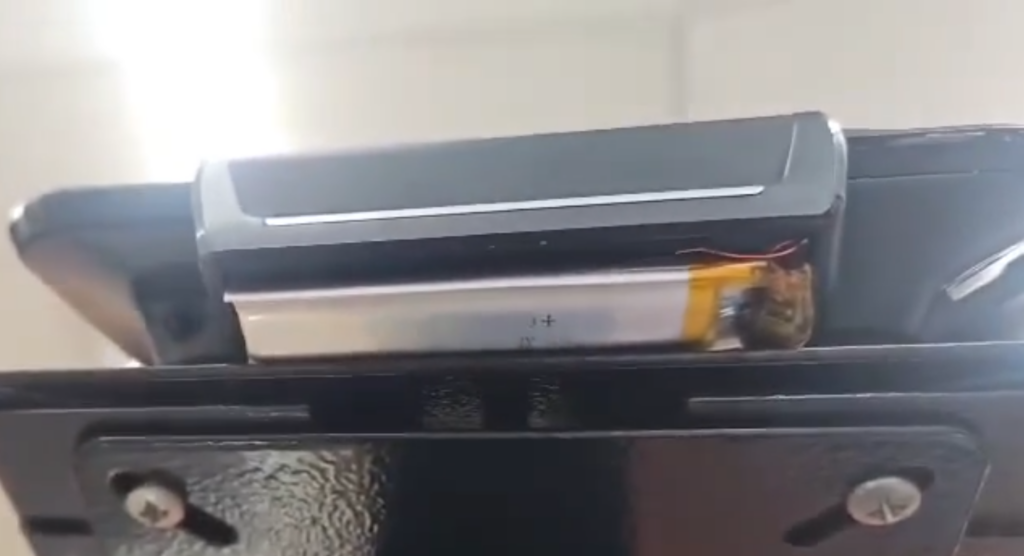

PIN pad skimmers are illicit devices affixed to legitimate card readers at point-of-sale (POS) terminals, such as those found in grocery stores. Their purpose is to covertly capture data from the magnetic strip of your credit or debit card, along with your entered PIN. Criminals can then use this information to create counterfeit cards or conduct unauthorized transactions. These skimmers are often meticulously crafted to blend seamlessly with existing hardware, making them challenging to detect.

Being vigilant is your first line of defense. Here are some indicators that a card reader may have been tampered with:

Some examples of skimmers are shown below:

Protecting your business from credit card skimming is crucial to maintain customer trust and prevent financial losses. Implement the following measures to enhance the security of your store:

Conduct daily inspections of your POS terminals for signs of tampering, such as loose parts, misaligned components, or unfamiliar attachments. Encourage your staff to be vigilant and report any irregularities immediately.

Upgrade your payment systems to accept EMV chip cards, which are more secure than traditional magnetic stripe cards. EMV technology significantly reduces the risk of skimming by generating unique transaction codes that are difficult to replicate.

Some retailers are adopting anti-skimming mounts and devices to protect their POS terminals from tampering. For instance, Target has developed the EasySweep device to detect and prevent skimmer installations.

Utilize fraud detection software to analyze transaction patterns and flag anomalies, such as multiple high-value purchases in a short period. This proactive approach can help identify and prevent fraudulent activities before they result in significant losses.

Educate your staff about common skimming tactics and the importance of verifying customer identities during transactions. For instance, instruct them to request identification for high-value purchases or when they suspect suspicious behavior.

If your business operates online, ensure that your website is secure by implementing SSL certificates and other security measures. Regularly monitor for data breaches and employ fraud detection tools to safeguard against unauthorized transactions.

If you detect a skimming device or suspect fraudulent activity, contact local law enforcement and your payment processor immediately. Prompt reporting can help prevent further incidents and protect your business and customers from potential fraud.

By implementing these measures, you can significantly reduce the risk of credit card skimming and enhance the overall security of your business operations.

Protecting your grocery store from PIN pad skimmers is an ongoing process that requires diligence, technological upgrades, and employee awareness. By regularly inspecting payment terminals, leveraging secure transaction technologies, and training staff on fraud prevention, you can create a safer shopping environment for your customers.

As criminals continue to develop more sophisticated skimming tactics, staying informed about emerging threats and evolving security measures is crucial. Consider working with your payment processor, POS provider, or cybersecurity experts to implement additional layers of protection.

Ultimately, a proactive approach to security not only helps prevent financial losses but also strengthens customer trust in your business. By prioritizing security, you demonstrate a commitment to protecting both your bottom line and the people who shop in your store.